ABOUT US

Evergreen combines insurance, financial services, banking and regulatory expertise to serve our members as an association and institution serving banks, credit unions and their CRB/HRB clients.

We enable our members to create value and overcome challenges using technology, compliance, and industry leading partners. Our solutions are deeply rooted in stability, regulatory frameworks, and are built to serve our constituents and their communities.

FREQUENTLY ASKED QUESTIONS

What are the qualifications to join?

Evergreen's Institutional members must meet the following criteria:

- Be a licensed and chartered financial institution, such as banks or credit unions

- Be in good standing with prudential regulatory authorities

- Serve or seek to serve marginalized industries in their communities, such as CRBs or HRBs

Evergreen's CRB & HRB members must meet the following criteria:

- Be a licensed CRB or HRB where required by jurisdiction.

- Be in good standing with all regulatory authorities

Am I eligible?

Any institution or business which meets the Evergreen Association's membership eligibility criteria may apply for membership. Visit joinevergreen.com or contact ISG@evergreenmemberservices.com

How are membership fees determined?

Membership fees vary depending on membership type and solutions utilized. Contact ISG@evergreenmemberservices.com to learn more about our membership fee methodology.

How long does Evergreen take to review submitted membership applications?

Evergreen's initial application review process is relatively straightforward and focuses on the eligibility of the applicant. Generally, this is completed in less than 2 weeks.

Members seeking to employ Evergreen solutions must complete a more extensive review process that emphasizes due diligence, regulatory compliance, and general financial condition. While some applications may be processed relatively quickly, others may require more time, especially if additional information or clarification is needed.

Once a member begins working with Evergreen's Institutional Solutions group to design their solution, ISG will request supplemental information to append to the originally submitted application. This submission then undergoes review by the Evergreen staff and may also involve input from Evergreen's Board of Directors or other relevant committees.

The review process may also include site visits, interviews, and additional documentation requests to ensure that the applying institution meets Evergreen's membership criteria.

What if my application is denied?

If an institution's membership application to Evergreen is denied, the reasons for the denial will typically be communicated to the institution. The denial could occur for various reasons, such as failure to meet eligibility criteria, concerns about financial stability or regulatory compliance, or insufficient contributions to the membership's mission and objectives.

After receiving a denial, the institution may have the option to appeal the decision or address any deficiencies identified in the application. This might involve providing additional documentation, addressing concerns raised by Evergreen, or taking corrective actions to strengthen the institution's application.

Alternatively, the institution may choose to reapply for membership at a later time, once any issues identified in the initial application have been resolved or circumstances have changed.

What solutions does Evergreen provide to members?

Evergreen Insurance Co. develops and offers institutional funding agreements to members of the Evergreen Association based on their specific goals and objectives.

Association members have access to additional solutions beyond those issued by the Evergreen Insurance Company.

What risks do members typically transfer to Evergreen?

While no two members are identical, the most common liabilities transferred to Evergreen center on:

- Deposit

- Liquidity

- Market

- Interest Rate

- Regulatory

- Industry-specific

How are Evergreen funding agreements structured?

Evergreen funding agreements are tailored to fit the needs of specific members and their communities.

Generally, funding agreements are structured to include various crediting strategies and durations. Evergreen's Rate Setting Committee declares the then-available rates, strategies and durations based on market conditions and the needs of our members.

To learn more about Evergreen's funding agreement structure contact ISG@evergreenmemberservices.com.

How do we get started?

Non-member institutions must first apply for membership at joinevergreen.org or by contacting ISG@evergreenmemberservices.com.

Member institutions seeking to leverage an Evergreen Insurance Company solution should contact their institutional service team.

Can I have multiple Evergreen funding agreements?

Evergreen members are permitted to hold multiple funding agreements simultaneously.

Often proposal design and underwriting anticipates the subsequent use of Evergreen solutions as a laddered approach to scale with CRB or HRB banking programs.

What if my customer incurs a regulatory enforcement action?

Evergreen solutions are built to address risks like these. If your institution receives a regulatory enforcement action resulting from the activities of your customer, contact your ISG representative.

Evergreen regulatory enforcement protocols are immediately escalated to the Office of the General Counsel and assigned overriding priority.

Can prospective members involve their examiners while evaluating membership?

Evergreen members and applicants are encouraged to include their examiner throughout their interactions with Evergreen.

Where is Evergreen Domiciled?

Evergreen is domiciled in Michigan as a limited certificate of authority insurance company that is charter bound to serving the members of the Evergreen Association.

Evergreen does not conduct business internationally or engage in any foreign transactions.

Who can use Evergreen Solutions?

Evergreen solutions are not made available to the public and are exclusively made available to members of the Evergreen Association.

Financial institutions, such banks or credit unions, as well as CRBs and HRBs can qualify for membership, visit joinevergreen.org or contact us by emailing ISG@evergreenmemberservices.com.

What are Evergreens Policies and Procedures?

Evergreen's policies and procedures manuals are continuously undergoing development, revision and improvement to bolster the firm's ability to identify, evaluate and mitigate risks.

These are made available by request and included in Evergreen's vendor risk assessment materials.

Is Evergreen required to have statutory reserves?

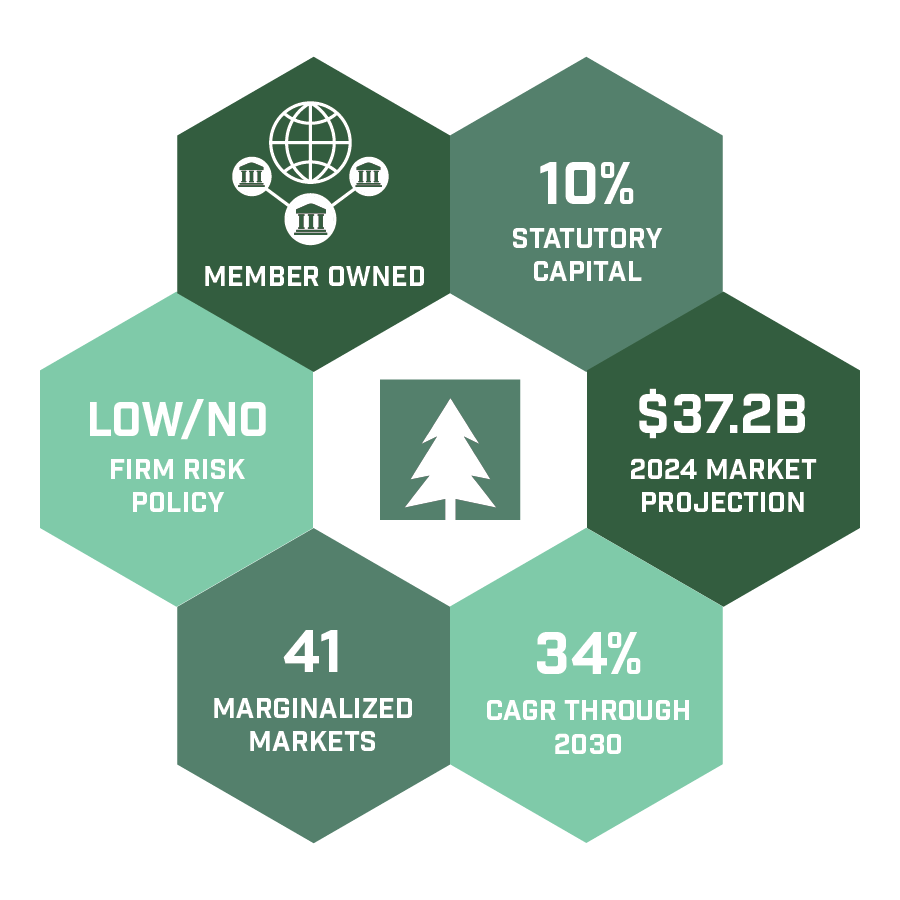

Yes - like all insurance companies Evergreen is required to set aside statutory capital to maintain financial stability, regulatory compliance and risk mitigation. Additionally Evergreen is required to maintain adequate levels of asset valuation reserves and interest maintenance reserves to further ensure long term sustainability.

How much statutory capital is considered prudent?

In the United States, insurance companies are regulated at the state level, and each state has its own regulations regarding statutory capital requirements. Typically, insurance regulators use risk-based capital (RBC) models, similar to CAMELS, to assess the capital adequacy of insurance companies. These models consider various factors such as asset risk, insurance risk, and operational risk to determine the amount of capital required.

While there isn't a specific amount or ratio on statutory capital universally deemed prudent for all life and annuity insurance carriers a surplus ratio of 8% is generally regarded as the standard and correlated to a 350-400% RBC score.

What does member owned mean?

Like many institutions, we are capitalized by

our members. In this way, Evergreen is similar to the Federal Home Loans Banks, credit unions

and mutual insurance companies many of our constituents are familiar with.

This model aligns our collective interests, serves marginalized members of our communities and supports stability at scale in adverse market conditions.

Members who use Evergreen's products contribute Activity Based Capital (ABC) proportional to their utilization of Evergreen solutions.

The purpose of the Activity Based Capital is a means to an end approach. That is to say, like all insurance companies, Evergreen maintains prudent reserves to protect the insurance company and its policyholders from the financial impact of the adverse performance of the underlying investments.

What does Evergreen invest in?

Evergreen has adopted a strictly conservative risk tolerance policy that guides and informs our investment policy statement.

Evergreen invests in diversified duration-matched high-quality investment-grade fixed-income securities and funds. Evergreen's investment focus is centered on book yield performance, duration matching, minimization of absolute losses, and support of excellent financial strength.

To learn more about Evergreen's approach to investing please contact the Institutional Solutions Group (ISG).

How does Evergreen perform stress testing?

As a regulated financial institution, Evergreen is bound by charter to maintain a framework that ensures capital adequacy.

As part of this core operational function, Evergreen's risk management protocols require Evergreen to undergo independent actuarial feasibility and stress testing that examines the firm's solvency against increasingly outlier financial market conditions. The outcomes of these tests are included in our periodic reporting to our members.

Does ABC pay dividends?

Activity Based Capital (ABC) contributed by members is expected to produce dividends similar to fixed account rates, but is not guaranteed to produce dividends.

Overall, the dividends from Evergreen serve as a source of income for its members and increase the composite performance of Evergreen's institutional solutions, incentivizing continued collaboration and improving banking outcomes for marginalized industries within their communities.

Does the par value of ABC stock change?

The par value of Evergreen stock does not change and is the nominal value assigned to shares of stock when it is issued and redeemed.

The par value does not fluctuate with changes in financial market conditions.

The market value determination of Evergreen stock may fluctuate based on various factors including financial performance, interest rate environment, and broad capital market conditions, however Evergreen stock is not transferrable and is tethered to the duration of the corresponding solution.

Changes to the par value of Evergreen stock, such as a stock split or reverse stock split, would require approval from the Evergreen Board of Directors and Evergreen's supervisory regulatory authorities.